We can now add politicians, economists, and financial wizards to our list of 'least trusted persons in America."

One of mankind's traits is to entrust others who talk a good story, without making much common sense. Those who have titles and have certificates on their walls from esteemed institutions of higher learning have gained our trust using it to their advantage, and to our disadvantage.

The recent culmination of financial misplanning, or should I say malfeasance and deception have finally effected our economic engine.....never ending credit.

There are many issues to bloviate upon.

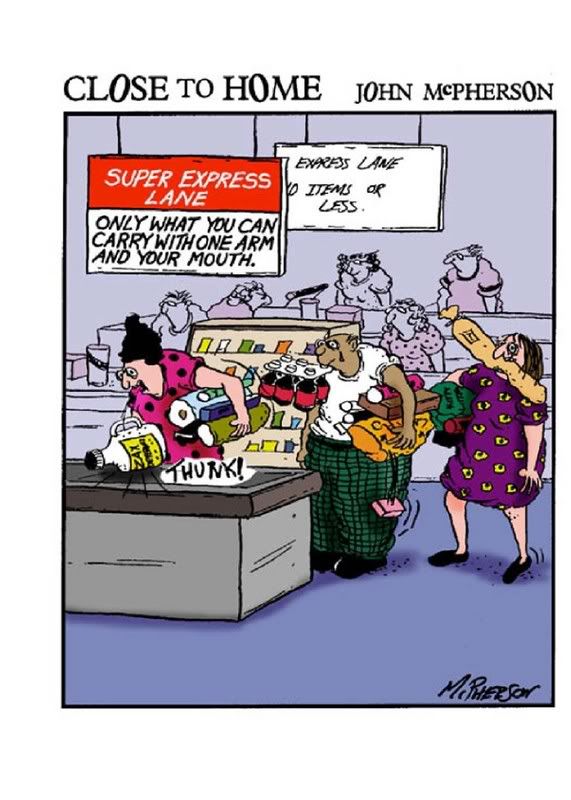

1. The mortgage meltdown. I will pass on that one..It is old news, and I doubt if anyone who really needs the bailout will get it. The pirates and predators of the banking world will feast on this new money to devour each other, get bigger, and make the branches even smaller. I knew we were in for a big problem when banks moved into grocery stores...

they could no longer afford to build banks, or rent professional looking business establishments. The whole evolution of getting loans online, ATMs, and any sort of bank service smelled to high heaven. Health pundits are always talking about how banking is fully automated...why isn't healthcare? Duh !?

Now you know.

2. The automobile industry has been a mess for decades. GM and Ford have had 25 years at least to get their sorry a--es out of the toilet. The UAW has been a large part of the problem. They are like the hyenas who bring down their prey with their jaws firmly attached to the gonads of their prey. Their leadership is still ranting and raving about how the UAW has given up enough and will not be persuaded to do more. They are in for a shocker when they are all laid off and their companies liquidated and sold off for their assets. It is my humble opinion that neither GM or Ford should be bailed out by taxpayer largess either with loans or buyouts. GM and Ford have failed us miserably. There are those who argue that they are the foundation of American productivity. That may be true, but the foundation long ago crumpled and the building collapsed into the basement.

The capitalized value of GM and Ford is only about 8 billion dollars. This is far less than the real assett value of either company. The companies are a complex network of suppliers, sub contractors, and production locations and workers. These assets can be sold to others who know and can translate what other car companies have done with their products throughout the world. We have already seen this with BMW and Toyota in South Carolina and other states.

General Motors and Ford have failed us and themselves. I would have no faith that things would change with 10,20 or 100 billion dollars. They have already been bailed out to retool and manufacture the new vehicles of the future. If we have to do that, then the chances of it working in the long run are nil.

Proponents of the bail out say that if GM and FORD are allowed to fail it would be catastrophic and lead to a depression. It's pretty catastrophic right now....Demand for automobiles has dropped as a combined assault of increasing energy prices and tightened consumer belts. This is a normal correction considering people need more spendable income for basic necessities of food, water and clothing. Demand will recover as transportation is a necessity of life in the United States. It seems perhaps too much given the price we pay for it in terms of energy, ecological damage, and poor air quality in most cities where the bulk of our population now reside. Yes there will be some more unemployment through a transition. Perhaps it will never recover, but an industry that cannot serve it's own people and employees is a farce. Admitting failure is the first step in reorganization and turn around.

To those whom I have spoken the general opinion is that there should not be a bailout of auto manufacturers. They are also highly skeptical about how the financial bailout is being supervised. It is obvious to anyone that the monies are not going where it was intended. Let them be transparent and publish the agreements (if there are any) for these funds to be used by the banks, and if we don't like it.....set up new institutions that will act responsibly and in the public's interest.

No comments:

Post a Comment